Innovative Financing for Cities: Pay for Results, Not Process

Who will you meet?

Cities are innovating, companies are pivoting, and start-ups are growing. Like you, every urban practitioner has a remarkable story of insight and challenge from the past year.

Meet these peers and discuss the future of cities in the new Meeting of the Minds Executive Cohort Program. Replace boring virtual summits with facilitated, online, small-group discussions where you can make real connections with extraordinary, like-minded people.

As cities face funding shortages for critical resilience and infrastructure projects, they are looking to new sources of capital—including impact investors. From large multinational banks to traditional institutional asset owners, to foundations and family offices, investors are looking to put their capital to work in ways that generate financial as well as social and environmental returns. The bottom line is: there is no shortage of the impact capital needed to finance innovative, nature-based solutions.

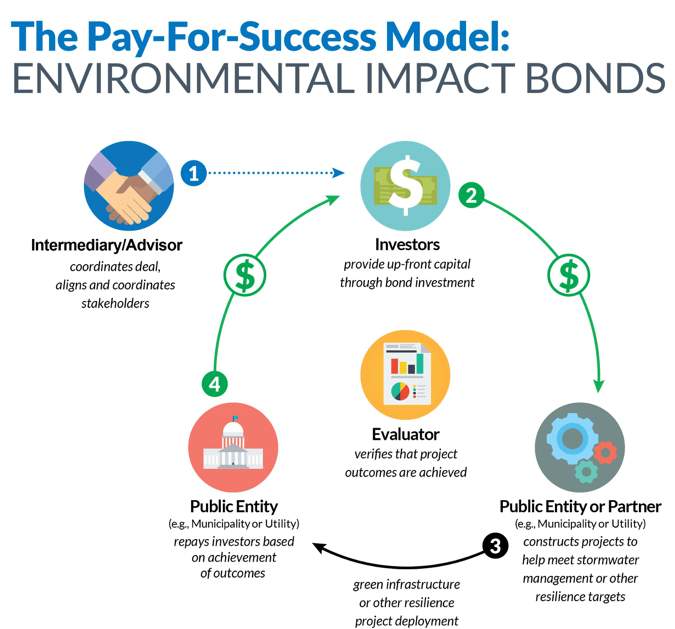

While there is great appetite from investors for “impact” deals, those deals can be hard to come by because they take time, collaboration, and creativity to structure. By matching the needs of cities with the goals of impact investors, places like Atlanta, Baltimore, and Washington, D.C. are taking advantage of a new financing model called the Environmental Impact Bond. It can be used to finance green infrastructure and similar resiliency-oriented projects, which not only protect cities against flooding and pollution, but also create jobs and green underserved neighborhoods. The return to investors of these projects is based on the extent to which the projects produce results; such as the amount of stormwater diverted from flowing into nearby rivers. If the project falls short, investors receive less returns, meaning that the City protects its budget for other projects. If the project overperforms, the investors get an additional return, which the City is willing to provide because it means the projects are more effective than expected, and therefore the City doesn’t have to invest as much capital into similar projects going forward.

Environmental Impact Bonds align incentives, and everyone wins.

Below, we outline the opportunities created, and also the challenges presented. This should help answer the questions around how your city can tap into this source of financing.

Opportunity: Risk-adjusted Innovation.

This is a new model that borrows from learnings and best practices in finance, the social sector, and government. Leaders with foresight and a strategic mindset are being creative, taking risks, and getting noticed for their efforts. In Atlanta, the City will be offering the Environmental Impact Bond publicly via the Neighborly bond issuance platform and using the investment dollars to fund resilience projects in the Westside neighborhoods, which are prone to flooding. “Utilities nationwide are searching for innovative ways to acquire creative financing, and these projects will successfully demonstrate how community partners working together can advance green infrastructure for our communities,” said Kishia Powell, the Commissioner of Atlanta’s Department of Watershed Management, of the recent Atlanta EIB announcement.

Challenge: Unfamiliarity.

The Environmental Impact Bond model is new and different. And change is always hard. As humans (and professionals), we naturally fight against it. So there is need to get everyone educated on these financial mechanisms and what they can do, as well as comfortable with how it works. In Baltimore, it was helpful to have strong internal champions as well as a partnership with the Chesapeake Bay Foundation, which interacts often with the city’s government. “Results matter. Local governments want a solution to this thorny problem of polluted runoff, but they also want to spend tax dollars wisely,” said Chesapeake Bay Foundation President Will Baker. “The use of this unique instrument for private investment offers better insurance that this expensive work will result in cleaner water, and the achievement of other community benefits in cities and towns.”

Chesapeake Bay Foundation CEO Will Baker at the public announcement of Baltimore’s Environmental Impact Bond project on March 26, 2018

Opportunity: Get started now.

This new source of capital—impact investing—isn’t going away. And, with the passage of The Social Impact Partnerships to Pay for Results Act (SIPPRA) legislation which appropriates $100 million to a Treasury-controlled fund as part of the federal budget in February, Pay for Results is here to stay as well. The Environmental Impact Bond provides an opportunity to harness the power of these new capital sources and a chance to get to know the players and the potential not only for green infrastructure projects, but also for areas like job creation, public health, and even recreational space. The National Forest Service is looking at working with partners to build an 88-mile single track mountain biking trail in Wayne National Forest — located in the hills of Southeast Ohio — and the potential for an Environmental Impact Bond to finance it. This could create an economic boost for this rural area by drawing new visitors to the Forest, generating tax revenues from tourism for local governments.

Challenge: Finding a fit.

Given the different resilience challenges and regulatory requirements in each city, the first few Environmental Impact Bonds will require quite a bit of customization and a lot of cooperation. The more of these deals that close, the more we will be able to standardize and replicate more aspects of them. For this type of financing to become a real movement, we need to bring down costs and increase efficiency and effectiveness. Fortunately, there has been philanthropic support for some of these projects (such as from the Rockefeller Foundation for the project in Atlanta), which helps us get more of these under our belt and continuously improve given what we learn.

Atlanta Mayor Keisha Lance Bottoms announces the city’s Department of Watershed Management’s Environmental Impact Bond project at the during the 17th annual Parks and Greenspace Conference at the Atlanta Botanical Gardens on March 26, 2018.

Opportunity: Stay curious. Learn. Repeat.

More than anything, we have to remain open to new ideas. We have enormous environmental, social, and economic challenges ahead, and we’ll need all the tools we can use to address overcome these challenges. The Environmental Impact Bond is just one, but it holds promise for a broader view of financing critical projects that support our communities.

Discussion

Leave your comment below, or reply to others.

Please note that this comment section is for thoughtful, on-topic discussions. Admin approval is required for all comments. Your comment may be edited if it contains grammatical errors. Low effort, self-promotional, or impolite comments will be deleted.

3 Comments

Submit a Comment

Read more from MeetingoftheMinds.org

Spotlighting innovations in urban sustainability and connected technology

Middle-Mile Networks: The Middleman of Internet Connectivity

The development of public, open-access middle mile infrastructure can expand internet networks closer to unserved and underserved communities while offering equal opportunity for ISPs to link cost effectively to last mile infrastructure. This strategy would connect more Americans to high-speed internet while also driving down prices by increasing competition among local ISPs.

In addition to potentially helping narrow the digital divide, middle mile infrastructure would also provide backup options for networks if one connection pathway fails, and it would help support regional economic development by connecting businesses.

Wildfire Risk Reduction: Connecting the Dots

One of the most visceral manifestations of the combined problems of urbanization and climate change are the enormous wildfires that engulf areas of the American West. Fire behavior itself is now changing. Over 120 years of well-intentioned fire suppression have created huge reserves of fuel which, when combined with warmer temperatures and drought-dried landscapes, create unstoppable fires that spread with extreme speed, jump fire-breaks, level entire towns, take lives and destroy hundreds of thousands of acres, even in landscapes that are conditioned to employ fire as part of their reproductive cycle.

ARISE-US recently held a very successful symposium, “Wildfire Risk Reduction – Connecting the Dots” for wildfire stakeholders – insurers, US Forest Service, engineers, fire awareness NGOs and others – to discuss the issues and their possible solutions. This article sets out some of the major points to emerge.

Innovating Our Way Out of Crisis

Whether deep freezes in Texas, wildfires in California, hurricanes along the Gulf Coast, or any other calamity, our innovations today will build the reliable, resilient, equitable, and prosperous grid tomorrow. Innovation, in short, combines the dream of what’s possible with the pragmatism of what’s practical. That’s the big-idea, hard-reality approach that helped transform Texas into the world’s energy powerhouse — from oil and gas to zero-emissions wind, sun, and, soon, geothermal.

It’s time to make the production and consumption of energy faster, smarter, cleaner, more resilient, and more efficient. Business leaders, political leaders, the energy sector, and savvy citizens have the power to put investment and practices in place that support a robust energy innovation ecosystem. So, saddle up.

Great financing model.

I am wondering how technical risk could be managed?

The process described makes sense, but the title of this statement is very misleading. The complexity of cities and their transformations require a focus on the governance process in order to explore co-benefits and win-win’s of the many sectorial challenges cities face: https://link.springer.com/article/10.1007/s10668-016-9760-4

By doing baseline assessment and setting clear goals, clear results can be obtained, but the process to acomplish this is the real challenge.

We want to start such project in Pakistan recently government of Khyber pukhtoon khawa,KPK, started one billion tree project and successfully completed .I am associated with adventure foundation of Pakistan and is working in inviromental field since 1981 with a letter of appreciation from prince Charles and out bound international USA.