Autonomous Vehicles: Where Are We Now, and Where Are We Headed?

Who will you meet?

Cities are innovating, companies are pivoting, and start-ups are growing. Like you, every urban practitioner has a remarkable story of insight and challenge from the past year.

Meet these peers and discuss the future of cities in the new Meeting of the Minds Executive Cohort Program. Replace boring virtual summits with facilitated, online, small-group discussions where you can make real connections with extraordinary, like-minded people.

The 2016 annual Meeting of the Minds acknowledged the rapid advancement of autonomous vehicle (AV) concepts towards widespread availability with a dedicated workshop and references in a session on linking vehicles to infrastructure. Although the focus to date by Federal and State agencies has been on safety, the workshop looked beyond this issue to explore how to promote their use in addressing mobility, environment, and equity issues in urban areas.

The workshop entitled “Getting Ahead of Autonomous Vehicles: Carbon, Congestion, Energy, and Policy: Carbon, Congestion, Energy, and Policy” examined three broad issues, each with a separate presenter: (1) the Columbus, OH Smart Cities Challenge Grant that includes a shared-ride AV element (Moderator/Presenter: Spencer Reeder, Senior Program Officer, Climate & Energy, Vulcan); (2) Autonomous Vehicle Policies/Regulations (Presenter: Amanda Eaken, Director of Transportation and Climate, Urban Solutions Program, Natural Resources Defense Council), and (3) Data Requirements (Presenter: Laura Schewel).

Recent Manufacture and Regulatory Actions

Recent actions by manufacturers and regulatory agencies provide a context for a summary of workshop discussions. Only a month earlier than the annual meeting, DOT’s U.S. National Highway Traffic Safety Administration (NHTSA) issued its “Federal Automated Vehicles Policy”, subtitled “Accelerating the Next Revolution in Roadway Safety”. It has the purpose of promoting the safe and efficient development and deployment of highly automated vehicles and recognizes regulatory needs for both testing and deployment. The document noted that in 2015, 35,092 people died on U.S. roadways, and 94 percent of crashes were tied to a human choice or error. As stated in the document, “Whether through technology that corrects for human mistakes, or through technology that takes over the full driving responsibility, automated driving innovations could dramatically decrease the number of crashes tied to human choices and behavior. HAVs (Highly Automated Vehicles) also hold a learning advantage over humans.”

New events or announcements have occurred throughout 2016. In October alone, Uber began serving customers with a limited AV taxicab system in Pittsburgh, only two months after a similar system began in Singapore. Also in October, Tesla announced that all of its models will have Autopilot hardware allowing for full autonomous control when the software is ready, including Model 3 that has almost 400,000 advance reservations with $1,000 deposits and mid-2017 availability. A semi-trailer truck with Uber’s OTTO autonomous vehicle system travelled driverless 120 freeway miles in Colorado except at the on and off ramps where a driver provided assistance. Finally, the Bloomberg Aspen Initiative on Cities and Autonomous Vehicles announced a program to help mayors in three U.S. and two foreign cities prepare for the emergence of autonomous vehicles.

AV development that began with Google AV vehicles in 2009 operating on local roads in Mountain View, CA now includes 33 companies, eleven of which have submitted applications for testing vehicles in California: Volkswagen Group of America, Mercedes Benz, Google, Delphi Automotive, Tesla Motors, Bosch, Nissan, Cruise Automation, BMW, Honda and Ford. Volvo has announced that it will accept full liability for any accidents for which its vehicles are at fault. Google’s testing now has two million miles of data. Tesla has plans to drive an automated vehicle across the county in 2017; and Ford, GM, and BMW are planning to sell fully autonomous vehicles by 2021.

Forecasts for the deployment of autonomous vehicles are bullish. Full adoption of major advances in vehicle technology historically has taken two to five decades. The deployment of autonomous vehicles is likely to be at the lower end of this range. Navigant Research (2015) has forecast that 85 million autonomous-capable vehicles will be sold world-wide by 2035. A forecast prepared for the State of Minnesota (2016) estimates that by 2030 full autonomous vehicles will be required in all new cars and that 10 years later all vehicles on the road will have this technology. A less ambitious forecast by the Victoria Transportation Policy Institute (2016) forecasts that autonomous vehicles will be 60% of vehicle sales and 40% of the overall fleet in the 2040s and that a mandate for these vehicles will not occur until 20 years later. No matter which forecast is accurate, planning needs to begin at all levels of government to account for impacts that can be both negative and positive.

NHTSA Autonomous Vehicle Performance Guidance

The NHTSA document deserves special attention as it establishes a framework for a discussion of autonomous vehicles at all levels of government. It defines five levels of automated vehicles, where:

- Level 1, an automated system on the vehicle can sometimes assist the human driver conduct some parts of the driving task;

- Level 2, an automated system on the vehicle can actually conduct some parts of the driving task, while the human continues to monitor the driving environment and performs the rest of the driving task;

- Level 3, an automated system can both actually conduct some parts of the driving task and monitor the driving environment in some instances, but the human driver must be ready to take back control when the automated system requests;

- Level 4, an automated system can conduct the driving task and monitor the driving environment, and the human need not take back control, but the automated system can operate only in certain environments and under certain conditions; and

- Level 5, the automated system can perform all driving tasks, under all conditions that a human driver could perform them.

Levels 1-5 all have automated systems designed to improve safety automated system, and Levels 1-3 require a driver to be present. For Levels 1 and 2, the driver retains primary responsibility for the operation of the vehicle. Level 1 systems have been widely available for several years as add-on equipment but do not change the overall driving experience. Level 2 is most likely a transitional technology, as the systems actually take over major driving tasks while the driver continually monitors operation and may have to immediately regain control. Levels 3-5 are considered by NHTSA as Highly Automated Vehicles (HAV). At Level 3, the automated systems are more advanced than in Level 2, and a driver will be given adequate warning if he or she needs to take back vehicle control. Only Levels 4 and 5 represent driverless operations where steering wheels can be eliminated. Level 4 vehicles are limited by one or more what NHTSA calls Operational Design Domains (ODDs), e.g. Geographic Location, Roadway Type, Speed, Day/Night, Weather Conditions. Most AVs are expected to operate at Level 4. Level 5 will be particularly difficult to obtain as immediate recognition and understanding of the driving environment is required at all times without any mapping.

For both testing and deployment of automated vehicles, manufacturers are required by NHTSA to submit a safety assessment that includes 15 areas, as follows: Data Recording and Sharing, Privacy, System Safety, Vehicle Cybersecurity, Human Machine Interface, Crashworthiness, Consumer Education and Training, Registration and Certification, Post-Crash Behavior, Federal, State and Local Laws, Ethical Considerations, Operational Design Domain, Object and Event Detection and Response, Fall Back (Minimal Risk Condition), and Validation Methods.

The document recognizes that AVs “have the potential to transform personal mobility and open doors to people” but leave goals other than safety to lower levels of government. State regulations for autonomous vehicles, required to be consistent with NHTSA performance guidance, are unlikely to go beyond safety issues. They will, however, take a strong interest through their Departments of Transportation to improve roadway capacity with infrastructure to support vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communications. Regional and local governments will have the ability to address policies other than congestion, such as equity, air pollution, and land use.

National Association of City Transportation Officials

The National Association of City Transportation Officials (NACTO) in June, 2016 took the early lead in looking at the potential positive and negative impacts of AVs at the local level with a short but important policy statement supportive of a long-term sustainable, accessible, and affordable transportation system for cities. A summary of the principles leading to such a system is as follows:

- Focus on full automation (Levels 4 and 5) that allows for driverless shared ride operation instead of half-measures that do not (Levels 2 and 3).

- Require that shared-ride, autonomous vehicles are electricity-powered.

- Involve transportation planning professionals from all modes of travel within urbanized areas, including roadways, public transit, pedestrians, and bicyclists.

- Require sharing of high-quality, standardized data that can enhance planning future urban visions with improved equity and repurposing of public space currently devoted to the movement and parking of vehicles.

- Fund research of the potential for autonomous vehicle technology to make cities safer, more efficient, and better places to live and work.

- Base infrastructure planning on “observed trends of shifts in automobile technology and the demographic acceptance of shared-ride vehicle travel.”

An important distinction exists to be made between potential AV benefits for medium and long-distance travel and urban environments. Except in urban environments AV impacts are expected initially to be negative. A lower perceived value of AV travel time with the same percentage of single occupancy vehicles could lead to an increase in trip-making and longer trips. On the other hand, lane capacity could be increased up to 100% when freeway AVs reach the number to justify a dedicated lane. The combination of V2V and V2I communications would then allow for platoons traveling at an optimum speed and a safe distance between vehicles. The increase in capacity would result from a consistent travel speed and elimination of the average 1.5 second driver reaction time in establishing a safe stop distance.

For the urban road system, congestion benefits would be minimal, but the overall potential for benefits would be greater. Even at low levels of implementation, mobility could be increased for residents unable to drive safely, including senior citizens, teenagers younger than the legal driving age, and the disabled. Early adopters would be organizations that are already providing transportation for these groups. Without the need for a driver, a staff person could travel in the vehicle and have the opportunity to discuss issues with riders related to the organization’s services.

The major benefits envisioned for an urban environment are based on a dramatic increase in car-sharing and ride-sharing. Adoption of AVs for these mobility options should be relatively quick as existing companies are already providing these services, i.e. Zipcar for car-sharing and Uber for ride-sharing. Recent research has estimated that car-sharing will increase significantly with the widespread deployment of AVs and will reduce automobile ownership by 43%. Off-street residential and on-street parking areas could be reduced even where public transit services are limited. Ride-sharing would provide even greater benefits, assuming the existence of sufficient V2V and V2I communications. Costs per rider would become lower with more efficient routing and driverless vehicles. Also, vehicles could be requested for any location in a city and at any time of day. Initially, an employee might travel in a vehicle to make reluctant customers feel more at ease in a driverless vehicle. Early adopters would be existing organizations that provide transportation services. Ride-sharing vehicles could be parked at a remote facility where charging and maintenance could occur at specified times.

Workshop Discussions

The workshop leader, Amanda Eaken, stressed the view that automated vehicles must move beyond safety. She noted that at the Federal and state levels, no employee currently resides with a title or primary responsibility for overseeing AVs. The overall discussions were separated into three broad topics, as follows, and for each problem areas were identified as well as possible solutions: (1) Columbus, OH Smart Cities Challenge Grant; (2) Autonomous Vehicle Policies/Regulations; and (3) Data Requirements, and Columbus was awarded a $50 million Challenge Grant in June, 2016.

Columbus Smart Cities

The City of Columbus, Ohio was awarded a $50 million Smart Cities Challenge Grant in June+, 2016, with $10 million from Vulcan, the Paul Allen Family Foundation group to focus on climate and energy. Local private and public entities committed to spending an additional $90 million as part of the 3-4 year project. Major transportation components include a commitment of corporations to switch to electric vehicle fleets and provide electric charging stations and deployment of six autonomous EVs on three shuttle routes serving a new transit station. Two will provide links to work centers, and the third to a major retail center. Vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) will ensure safe operation and allow for fall-back operation at both local and remote locations.

The project, as proposed, does not have prescriptive deadlines or actions. An integrated data acquisition and management system will provide for extensive monitoring of project elements so that necessary changes can be made quickly. It is the first of what hopefully will be a series of laboratories for testing innovative sustainable transportation strategies in a real-life situation.

Mr. Reeder pointed to two 2016 events that he thinks have kick-started the recent major investments in electric, automated vehicles by vehicle manufacturers. First, Germany’s legislature adopted a resolution in October, 2016 that by 2030 only zero emission passenger vehicles will be approved. Although having no legal authority, Germany’s resolutions historically have shaped European Union regulations. Second, within one week, Tesla received 300,000 pre-orders for a $1,000 down of its $35,000 Tesla 3 despite a two-year waiting period. The pre-orders represent the most successful automobile launch in history. Additionally, EV trends for initial cost and mileage between charges are encouraging. The cost of batteries has decreased 35% over the past year, and GM has announced 238 maximum miles between charges for its Chevy Bolt. Finally, two new companies, Fiskar and Lucid Motors, hope to challenge Tesla as companies only manufacturing electric vehicles.

Regulations

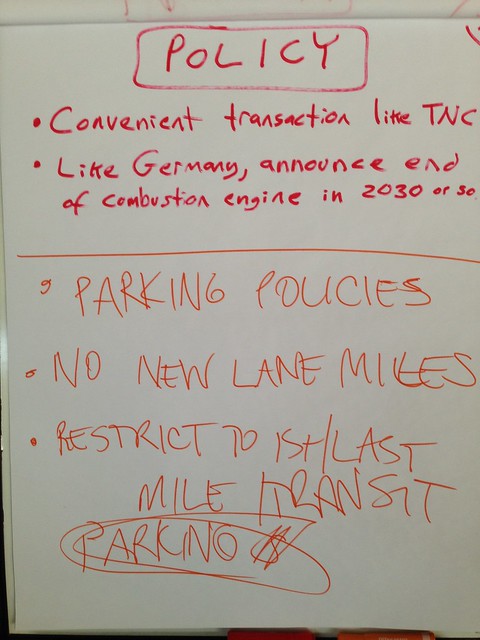

Local regulations need to be consistent with Federal and State regulations, but should reflect additional benefits that can accrue to urban areas. Some of the regulatory concepts listed below hopefully could be incorporated into State regulations:

- Resist temptations to define standards too strictly and prematurely. Regulations and performance standards, particularly for urban operations, will change over time as AV market penetration increases.

- Regulations at Federal and State levels are likely to focus on safety but need to allow for customized operational domains, such as highway operations and moving in and out of parking facilities.

- Autonomous vehicles within cities should be electrical vehicles.

- Incorporate the potential impacts of AVs in the development of future transportation and land use visions that reflect equity, environmental concerns, and safety.

- Provide peripheral parking facilities for shared-ride vehicles with charging stations to allow for reduction of both on-street and off-street parking requirements.

- Coordinate with housing policies, i.e. provide conditions of approval that reduce parking requirements while improving mobility, such as parking spaces and charging stations for electric car sharing vehicles, and free or reduced-price transit passes. Reduce future roadway infrastructure costs.

- Understand sphere of control for services. Establish, to the extent possible, regulations regarding rate structures and service areas.

- Develop alternative scenarios for widespread AV deployment. Existing long-range traffic models assume existing driving behavior and mode split preferences. A need exists to examine the high level of market penetration that will occur for AVs over the next 20 years.

- Financing Options: cost savings for users (insurance, parking fees, vehicle operating costs), housing developers, major employers, commuter checks, parking revenue. (operating model)

- Dynamic pricing based on occupancy

- Operating strategies

- Plan for future repurposing of on-street parking areas with public plazas and landscaping.

- Access to bus lanes and HOV lanes.

- Define Liability and Relationship to Licensing and Ownership. Full liability for Level 4 vehicles (driverless) should belong with manufacturers as they have full responsibility for both hardware and software. Volvo already has adopted this position, and other manufacturers are likely to follow. Ownership by private individuals should be discouraged.

- Increase capacity of limited-access roads with efficient vehicle platooning utilizing V2V and V2I.

- Financing: User taxes need to be developed to offset the loss of gas tax revenue and to provide for infrastructure, such as peripheral parking facilities for shared-ride AVs, that normally are not funded with user fees. Among the possibilities are VMT fees for shared-ride vehicles operating within a city’s boundaries, annual parking fees for peripheral parking facilities and for private off-street parking spaces, and cordon fees for vehicles entering a City.

- Education: Local governments should provide outreach to education residents and visitors in the use of all travel modes, including ride-sharing services.

Data

Data should support regulations at the Federal, State, and local levels as well as additional data to support local goals and to protect privacy and provide security for personal data:

- Open and Interoperable: allows sharing of common data, such as mapping, with operators and joint use of V2V and V2I communications.

- Provide data related to fees approved for financing transportation services and infrastructure.

- Mapping of road features: Real-time updates are necessary for safe operation of driverless vehicles, especially when major incidents or major road improvements occur.

- Support of complementary travel modes. AV ride-sharing and car-sharing systems should focus on complement existing transit services rather than competing with them.

- Communication systems need adequate protection of personal user data.

- Privacy – Balance between detailed data and privacy concerns, anonymous vehicle ID stored rather than license plate number, origins and destinations not stored as addresses but blocks or nearest intersection or milepost rounded to nearest whole number.

- Equity – A need exists to ensure that an entire city has efficient and affordable mobility. Taxicabs tend to focus on areas of high demand. Uber vehicles, likewise, concentrate on areas that have good transit and taxicab service.

- Need data connections between modes of travel: Such connections are necessary for users to do real-time planning of multi-modal trips.

- Need to develop new performance measures beyond safety to look at equity and environmental goals. Such measures would include mobility by subarea, age, and health status; vehicle occupancy, air pollution reduction, and reduction in auto ownership/capita,

- User behavior – elasticity of demand based on price, response/time, travel time, shared vs. non-shared service, and driver vs. driverless shared-ride service.

- Demographic profiles – age, income, car ownership.

- Surveys – public support, knowledge of service availability

- Vehicle ownership – individual purchase, individual lease, company ownership, company lease, manufacturer ownership.

- Integrate Data Analysis at Local, Regional, and State levels: Trend lines for AV deployment and impacts are uncertain. Federal and State data requirements being implemented should reflect needs at the regional and local levels.

- Trend Analysis and Forecast Updates. Planning and deployment of appropriate infrastructure improvements, e.g. vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication capabilities, depend upon market penetration of AVs at any given time and improvement of AV in-vehicle hardware and software. Trends in manufacturing of AV vehicles and their public acceptance by individuals and both private and public operators is important to ensure effective use of local financial resources.

- Relate data requirements to city goals and overall vision: AV deployment has the potential to reduce future needs for road widening and to allow repurposing of existing land now in use for vehicle parking.

- Analyze impacts on existing transportation services: The potential exists for shared-ride operations to reduce transit ridership.

- Adequate data collection to meet Operational Design Domain (ODD): Customized software and data requirements may be necessary for specific geographic areas or user groups. Data needs to be provided to ensure that AVs have the capability to operate within this domain at all times.

- Waiting time data: A key issue in ensuring mobility is to minimize waiting time for both scheduled and on-demand services.

Workshop participants were in agreement that autonomous vehicles, as a disruptive technology, can be harnessed to develop an improved vision for transportation mobility that reduces the current focus on the automobile. To advance this vision, local agencies must participate in the on-going development of regulations at the Federal and State levels and customize them to meet local conditions. The key unknown variables are public acceptance of AV car-sharing and ride-sharing services and whether or not they can be both efficient and affordable for all residents and visitors.

Workshop Notes

Discussion

Leave your comment below, or reply to others.

Please note that this comment section is for thoughtful, on-topic discussions. Admin approval is required for all comments. Your comment may be edited if it contains grammatical errors. Low effort, self-promotional, or impolite comments will be deleted.

Read more from MeetingoftheMinds.org

Spotlighting innovations in urban sustainability and connected technology

Middle-Mile Networks: The Middleman of Internet Connectivity

The development of public, open-access middle mile infrastructure can expand internet networks closer to unserved and underserved communities while offering equal opportunity for ISPs to link cost effectively to last mile infrastructure. This strategy would connect more Americans to high-speed internet while also driving down prices by increasing competition among local ISPs.

In addition to potentially helping narrow the digital divide, middle mile infrastructure would also provide backup options for networks if one connection pathway fails, and it would help support regional economic development by connecting businesses.

Wildfire Risk Reduction: Connecting the Dots

One of the most visceral manifestations of the combined problems of urbanization and climate change are the enormous wildfires that engulf areas of the American West. Fire behavior itself is now changing. Over 120 years of well-intentioned fire suppression have created huge reserves of fuel which, when combined with warmer temperatures and drought-dried landscapes, create unstoppable fires that spread with extreme speed, jump fire-breaks, level entire towns, take lives and destroy hundreds of thousands of acres, even in landscapes that are conditioned to employ fire as part of their reproductive cycle.

ARISE-US recently held a very successful symposium, “Wildfire Risk Reduction – Connecting the Dots” for wildfire stakeholders – insurers, US Forest Service, engineers, fire awareness NGOs and others – to discuss the issues and their possible solutions. This article sets out some of the major points to emerge.

Innovating Our Way Out of Crisis

Whether deep freezes in Texas, wildfires in California, hurricanes along the Gulf Coast, or any other calamity, our innovations today will build the reliable, resilient, equitable, and prosperous grid tomorrow. Innovation, in short, combines the dream of what’s possible with the pragmatism of what’s practical. That’s the big-idea, hard-reality approach that helped transform Texas into the world’s energy powerhouse — from oil and gas to zero-emissions wind, sun, and, soon, geothermal.

It’s time to make the production and consumption of energy faster, smarter, cleaner, more resilient, and more efficient. Business leaders, political leaders, the energy sector, and savvy citizens have the power to put investment and practices in place that support a robust energy innovation ecosystem. So, saddle up.

0 Comments